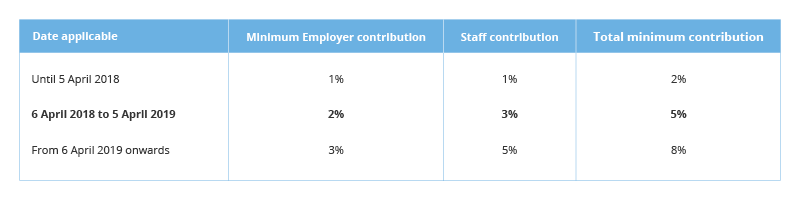

Employer and employee Minimum Pension Contributions are set to increase from April 2018. These changes will apply to all employers who have put their staff in a pension scheme for automatic enrolment. To ensure you comply, you will need to ensure that at least the minimum amount is paid by you and your staff:

The increases to Minimum Pensions Contributions are listed as follows:

As an employer, you must make a minimum contribution towards this amount and employees must make up the difference. However, this will not apply if an employee has opted out of the workplace pension scheme. In cases where employer contributions are already higher than the minimum threshold, no changes will be necessary.

It is your responsibility as an employer to comply with the legislation, inform your employees and make payments on time.

If you have any questions about the upcoming changes contact a member of the Walker Begley team on 01925 210 000